Latest News

Mass Dems propose nine-month shelter stay limit

Mass Dems propose nine-month shelter stay limit

Sportsman’s Corner: Missouri gobbler

Sportsman’s Corner: Missouri gobbler

North Quabbin Notes, April 25

North Quabbin Notes, April 25

Erving rejects trade school’s incomplete proposal for mill reuse

ERVING — While the Selectboard was forced to reject the lone procurement submission for the former International Paper Mill because it was incomplete, members hope the applicant’s idea could be a window to future opportunities.Hancock Academy is...

Students plant red maple outside Athol Community Elementary School

ATHOL – Arbor Day was celebrated a day early Thursday morning as fourth-graders from Athol Community Elementary School joined town officials and public works employees for the planting of a tree at the school.A red maple sapling now graces a strip of...

Most Read

Plan calls for upgrades to Silver Lake in Athol

Plan calls for upgrades to Silver Lake in Athol

Magic comes to Red Apple in Phillipston

Magic comes to Red Apple in Phillipston

Parents question handling of threat at Erving Elementary School

Parents question handling of threat at Erving Elementary School

On The Ridge with Joe Judd: What time should you turkey hunt?

On The Ridge with Joe Judd: What time should you turkey hunt?

Erving rejects trade school’s incomplete proposal for mill reuse

Erving rejects trade school’s incomplete proposal for mill reuse

Orange man gets 12 to 14 years for child rape

Orange man gets 12 to 14 years for child rape

Editors Picks

Sportsman’s Corner: Turkey time

Sportsman’s Corner: Turkey time

With eye toward teaching firearm safety, Mahar’s Junior ROTC adding air rifles

With eye toward teaching firearm safety, Mahar’s Junior ROTC adding air rifles

Mass. saw nearly 200 percent rise in antisemitic incidents last year

Mass. saw nearly 200 percent rise in antisemitic incidents last year

North Quabbin Notes, April 23

North Quabbin Notes, April 23

Sports

Track & field: Greenfield, Mohawk Trail split dual meet

It was a dual meet split for the Greenfield and Mohawk Trail track and field teams on Thursday.The Greenfield boys captured a 90-54 victory over the Warriors while the Mohawk Trail girls snagged a 123-18 victory over the Wave.Here are the winners from...

Country Club of Greenfield holding Youth Golf Camp June 24-27

Country Club of Greenfield holding Youth Golf Camp June 24-27

Opinion

My Turn: A moral justification for civil disobedience to abortion bans

Over the last several years, in response to abortion bans and restrictions, advocates around the country have developed an alternative supply network for abortion pills outside of the medical system and the law.As a lawyer and law-abiding citizen, I...

Guest columnist Rudy Perkins: Dangerous resolution on Iran

Guest columnist Rudy Perkins: Dangerous resolution on Iran

Guest columnists Ellen Attaliades and Lynn Ireland: Housing crisis is fueling the human services crisis

Guest columnists Ellen Attaliades and Lynn Ireland: Housing crisis is fueling the human services crisis

My Turn: April is second chance month

My Turn: April is second chance month

Police Logs

Athol Police Logs: March 12 to March 19

ATHOL POLICE LOGSTuesday, March 126:45 p.m. - Male party into the lobby regarding a shop vac he lent to someone and they are refusing to give it back. Party was advised of his options. Attempted to contact involved party, negative contact, a voicemail...

Athol Police Logs: Feb 19 to Feb. 27

Athol Police Logs: Feb 19 to Feb. 27

Athol Police Log Feb. 4-18

Athol Police Log Feb. 4-18

Orange Police Log 12/1-13

Orange Police Log 12/1-13

Athol Police Log 11/8-26

Athol Police Log 11/8-26

Arts & Life

Sounds Local: A rock circus returns to Turners Falls: The Slambovian Circus of Dreams brings the fun Friday night at the Shea

The circus is coming to town, and not the kind with elephants and clowns. I’m talking about the Slambovian Circus of Dreams, a rock group from the Hudson Valley in New York that makes music as unique as its name. The band, which has frequently...

Obituaries

Mary M. Thompson

Mary M. Thompson

Mary M. (Powers) Thompson Dade City, FL - Mary M. (Powers) Thompson passed away unexpectedly on Sunday, April 14, 2024. She was born at Langley Air Force Base, in Hampton VA, on February 17, 1968, the daughter of Robert H. and Joan (Lint... remainder of obit for Mary M. Thompson

Nancy C. Skowrowski

Nancy C. Skowrowski

Nancy C Skowronski Royalston, MA - Nancy C Skowronski, born in Worcester, MA on January 1, 1943, lived a captivating life, filled with vibrant memories and impactful experiences that created a lasting legacy. A resident of Royalston, Mas... remainder of obit for Nancy C. Skowrowski

Robert E. Thayer

Robert E. Thayer

Robert E. "Bob" Thayer Athol, MA - ATHOL - Robert E. "Bob" Thayer, 90 of Athol passed away Sunday, April 14, 2023, in the Athol Hospital. He was born on July 13, 1933, the son of Robert H. Thayer and Louise E. (King) Thayer. Bob graduat... remainder of obit for Robert E. Thayer

Chris N. Boyle

Chris N. Boyle

8/5/1956 - 4/11/2024 ORANGE, MA - Chris Boyle, beloved father and husband, passed away on April 11, 2024 at home. Chris led a life of unwavering dedication to his family, a steadfast commitment to the land he cherished, and a love for ... remainder of obit for Chris N. Boyle

Federal probe targets UMass response to anti-Arab incidents

Federal probe targets UMass response to anti-Arab incidents

A Page from North Quabbin History: Women of Royalston display

A Page from North Quabbin History: Women of Royalston display

Spilka pledges ‘comprehensive climate bill’ in Senate

Spilka pledges ‘comprehensive climate bill’ in Senate

Senate adds bills to reform electric industry

Senate adds bills to reform electric industry

High schools: Amy Mihailicenco, Greenfield girls tennis edge Turners Falls (PHOTOS)

High schools: Amy Mihailicenco, Greenfield girls tennis edge Turners Falls (PHOTOS) Softball: Turners edges Tech, Greenfield’s Paulin notches 100th hit, Mahar win first game since 2019

Softball: Turners edges Tech, Greenfield’s Paulin notches 100th hit, Mahar win first game since 2019 High schools: Lilly Ross records 100th career hit in Franklin Tech’s win over Northampton

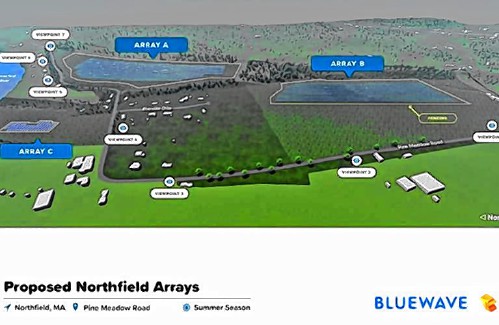

High schools: Lilly Ross records 100th career hit in Franklin Tech’s win over Northampton My Turn: Industrial solar installations are overwhelming Northfield neighborhood

My Turn: Industrial solar installations are overwhelming Northfield neighborhood Rescuing food and feeding people: Rachel’s Table programs continue to expand throughout western Mass

Rescuing food and feeding people: Rachel’s Table programs continue to expand throughout western Mass A day to commune with nature: Western Mass Herbal Symposium will be held May 11 in Montague

A day to commune with nature: Western Mass Herbal Symposium will be held May 11 in Montague Speaking of Nature: ‘Those sound like chickens’: Wood frogs and spring peepers are back — and loud as ever

Speaking of Nature: ‘Those sound like chickens’: Wood frogs and spring peepers are back — and loud as ever Hitting the ceramic circuit: Asparagus Valley Pottery Trail turns 20 years old, April 27-28

Hitting the ceramic circuit: Asparagus Valley Pottery Trail turns 20 years old, April 27-28