Regional farming alliance strengthens educational, networking opportunities for apprentices

In 1994, a new movement began to grow out of the Pioneer Valley, Berkshires and Hudson Valley, as a group of organic farmers banded together to form a cooperative educational program for farm apprentices.That year marked the birth of the Collaborative...

Nicole Gough seeks seat on Phillipston Selectboard

PHILLIPSTON – After living in town for two decades, Nicole Gough has decided it’s time to make her first foray into local politics.Gough is running to fill the one year remaining on the term of former Selectboard member Dan Sanden, who resigned...

Sports

High schools: South Hadley softball holds off Frontier rally for 5-4 victory (PHOTOS)

A day after completing a comeback victory over Greenfield, the Frontier softball team looked like it had another rally in the works on Friday against South Hadley.The Tigers held a 1-0 lead going into the sixth inning when the Redhawks rallied,...

Opinion

Connecting the Dots: In what world do you want to live?

I find myself acutely aware of living in three worlds right now. The biggest one is the Universe that is large beyond my comprehension. My awareness was sharpened by watching the eclipse with my sister from two camp chairs in my driveway. Watching the...

Jessica Zhang: Weigh your choices — Solar power a better alternative

Jessica Zhang: Weigh your choices — Solar power a better alternative

My Turn: Saving planet Greenfield

My Turn: Saving planet Greenfield

Gary Seldon: Solar Roller Earth Day River Ride

Gary Seldon: Solar Roller Earth Day River Ride

Police Logs

Athol Police Logs: March 12 to March 19

ATHOL POLICE LOGSTuesday, March 126:45 p.m. - Male party into the lobby regarding a shop vac he lent to someone and they are refusing to give it back. Party was advised of his options. Attempted to contact involved party, negative contact, a voicemail...

Athol Police Logs: Feb 19 to Feb. 27

Athol Police Logs: Feb 19 to Feb. 27

Athol Police Log Feb. 4-18

Athol Police Log Feb. 4-18

Orange Police Log 12/1-13

Orange Police Log 12/1-13

Athol Police Log 11/8-26

Athol Police Log 11/8-26

Arts & Life

Hitting the ceramic circuit: Asparagus Valley Pottery Trail turns 20 years old, April 27-28

A lot can change in 20 years: Presidents and other politicians come and go, new cultural fads and technologies emerge, clothing styles morph, and music and movies take on different dimensions.In these parts, one tradition hasn’t changed. Since 2005,...

Obituaries

Nancy C. Skowrowski

Nancy C. Skowrowski

Nancy C Skowronski Royalston, MA - Nancy C Skowronski, born in Worcester, MA on January 1, 1943, lived a captivating life, filled with vibrant memories and impactful experiences that created... remainder of obit for Nancy C. Skowrowski

Robert E. Thayer

Robert E. Thayer

Robert E. "Bob" Thayer Athol, MA - ATHOL - Robert E. "Bob" Thayer, 90 of Athol passed away Sunday, April 14, 2023, in the Athol Hospital. He was born on July 13, 1933, the son of Robert H. ... remainder of obit for Robert E. Thayer

Chris N. Boyle

Chris N. Boyle

8/5/1956 - 4/11/2024 ORANGE, MA - Chris Boyle, beloved father and husband, passed away on April 11, 2024 at home. Chris led a life of unwavering dedication to his family, a steadfast co... remainder of obit for Chris N. Boyle

Donn K. Clifford

Donn K. Clifford

PHILLIPSTON, MA - Donn K. Clifford, 74, of Barre Road, died on Wednesday, April 10, 2024 at Heywood Hospital in Gardner. Born in Gardner on August 15, 1949, he was the son of Robert Cliffo... remainder of obit for Donn K. Clifford

Shelter money fading, but ‘not at the end of the line’

Shelter money fading, but ‘not at the end of the line’

With eye toward teaching firearm safety, Mahar’s Junior ROTC adding air rifles

With eye toward teaching firearm safety, Mahar’s Junior ROTC adding air rifles

Sportsman’s Corner: Quabbin opens this Saturday

Sportsman’s Corner: Quabbin opens this Saturday

North Quabbin Notes, April 18

North Quabbin Notes, April 18

Partnership succeeds in protecting Lake Monomonac forestland

Partnership succeeds in protecting Lake Monomonac forestland

Orange man gets 12 to 14 years for child rape

Orange man gets 12 to 14 years for child rape

Franklin County youth tapped to advise governor’s team

Franklin County youth tapped to advise governor’s team

Athol Police Logs: March 27 to April 10, 2024

Athol Police Logs: March 27 to April 10, 2024

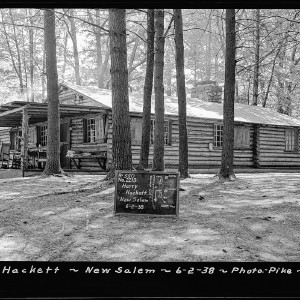

A Page from North Quabbin History: Quabbin Reservoir photo archives

A Page from North Quabbin History: Quabbin Reservoir photo archives

Sportsman’s Corner: Turkey time

Sportsman’s Corner: Turkey time Equity, income concerns flagged in free college debate

Equity, income concerns flagged in free college debate New fed rules may force Mass. action on PFAS

New fed rules may force Mass. action on PFAS Historical society presents history of Nichewaug

Historical society presents history of Nichewaug Softball: Franklin Tech’s Hannah Gilbert holds Hopkins to two hits, leads Eagles to 7-1 victory (PHOTOS)

Softball: Franklin Tech’s Hannah Gilbert holds Hopkins to two hits, leads Eagles to 7-1 victory (PHOTOS) Keeping Score with Chip Ainsworth: What’s ahead for Greg Carvel’s crew?

Keeping Score with Chip Ainsworth: What’s ahead for Greg Carvel’s crew? High schools: Abigail Schreiber’s hit propels Frontier softball past Greenfield, 3-2

High schools: Abigail Schreiber’s hit propels Frontier softball past Greenfield, 3-2 Baseball: Frontier handles Greenfield 12-2 in five-inning victory (PHOTOS)

Baseball: Frontier handles Greenfield 12-2 in five-inning victory (PHOTOS) Mitch Speight and Joan Marie Jackson: City should follow constitutional ruling on property takings

Mitch Speight and Joan Marie Jackson: City should follow constitutional ruling on property takings Best Bites: A familiar feast: The Passover Seder traditions and tastes my family holds dear

Best Bites: A familiar feast: The Passover Seder traditions and tastes my family holds dear Valley Bounty: Your soil will thank you: As garden season gets underway, Whately farm provides ‘black gold’ to many

Valley Bounty: Your soil will thank you: As garden season gets underway, Whately farm provides ‘black gold’ to many Painting a more complete picture: ‘Unnamed Figures’ highlights Black presence and absence in early American history

Painting a more complete picture: ‘Unnamed Figures’ highlights Black presence and absence in early American history Earth Matters: From Big Sits to Birdathons: Birding competitions far and near

Earth Matters: From Big Sits to Birdathons: Birding competitions far and near