Magic comes to Red Apple in Phillipston

PHILLIPSTON — Red Apple Farm will become home to faeries, knights, trolls and lots of magic on the first weekend in May.The Enchanted Orchard Renaissance Faire will take place on May 4-5. Richard and Rajuli Fahey of Winchendon have been to the farm a...

Plan calls for upgrades to Silver Lake in Athol

ATHOL – Residents and town officials joined members of the Open Space & Recreation Commission for a walking tour of Silver Lake Park Tuesday night.The purpose of the meeting, which convened at the park’s pavilion, was to discuss a master plan for the...

Most Read

Plan calls for upgrades to Silver Lake in Athol

Plan calls for upgrades to Silver Lake in Athol

Athol Royalston School Committee approves budget on second attempt

Athol Royalston School Committee approves budget on second attempt

Magic comes to Red Apple in Phillipston

Magic comes to Red Apple in Phillipston

Orange man gets 12 to 14 years for child rape

Orange man gets 12 to 14 years for child rape

Parents question handling of threat at Erving Elementary School

Parents question handling of threat at Erving Elementary School

A Page from North Quabbin History: Women of Royalston display

A Page from North Quabbin History: Women of Royalston display

Editors Picks

Sportsman’s Corner: Turkey time

Sportsman’s Corner: Turkey time

Equity, income concerns flagged in free college debate

Equity, income concerns flagged in free college debate

Franklin County youth tapped to advise governor’s team

Franklin County youth tapped to advise governor’s team

Athol Police Logs: March 27 to April 10, 2024

Athol Police Logs: March 27 to April 10, 2024

Sports

Country Club of Greenfield holding Youth Golf Camp June 24-27

The Country Club of Greenfield is holding its Youth Golf Camp from June 24-27. The camp will be capped at 25 children on a first come, first serve basis. The fee is $170 for the first family member and $140 for each additional family member. The camp...

High schools: Lilly Ross records 100th career hit in Franklin Tech’s win over Northampton

High schools: Lilly Ross records 100th career hit in Franklin Tech’s win over Northampton

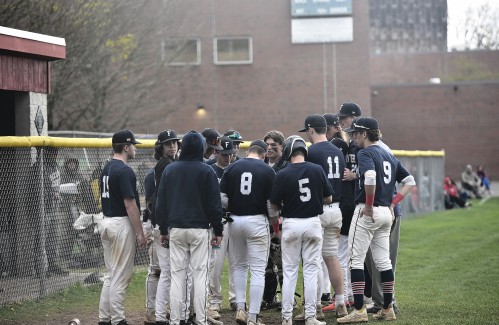

Baseball: Wyatt Edes’ walk-off single lifts Frontier past Amherst 6-5

Baseball: Wyatt Edes’ walk-off single lifts Frontier past Amherst 6-5

On The Ridge with Joe Judd: What time should you turkey hunt?

On The Ridge with Joe Judd: What time should you turkey hunt?

High Schools: Jakhia Williams propels Turners girls track past Athol

High Schools: Jakhia Williams propels Turners girls track past Athol

Opinion

Guest columnists Ellen Attaliades and Lynn Ireland: Housing crisis is fueling the human services crisis

Vacancies at programs operated by human services providers — despite some progress over the last two years — are still much too high. More than one in four direct support professional positions in adult residential and day programs for people with...

My Turn: April is second chance month

My Turn: April is second chance month

My Turn: Judgmental about malaise

My Turn: Judgmental about malaise

Ahmad Esfahani: Aiding and abetting and middle school angst

Ahmad Esfahani: Aiding and abetting and middle school angst

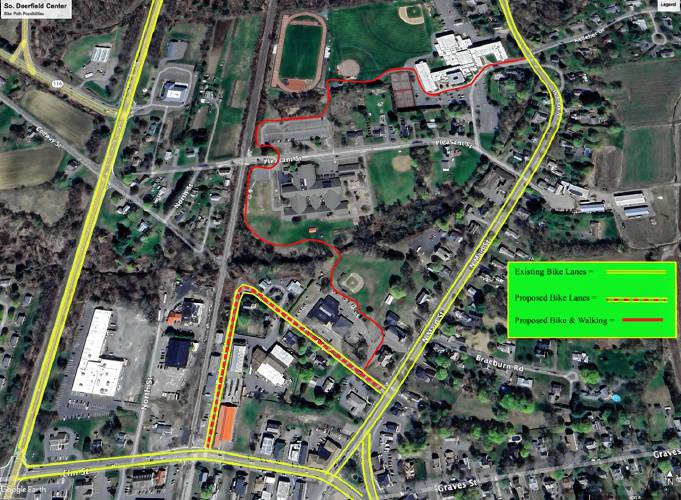

Greg Franceschi: Support bike lanes and walking paths in South Deerfield

Greg Franceschi: Support bike lanes and walking paths in South Deerfield

Police Logs

Athol Police Logs: March 12 to March 19

ATHOL POLICE LOGSTuesday, March 126:45 p.m. - Male party into the lobby regarding a shop vac he lent to someone and they are refusing to give it back. Party was advised of his options. Attempted to contact involved party, negative contact, a voicemail...

Athol Police Logs: Feb 19 to Feb. 27

Athol Police Logs: Feb 19 to Feb. 27

Athol Police Log Feb. 4-18

Athol Police Log Feb. 4-18

Orange Police Log 12/1-13

Orange Police Log 12/1-13

Athol Police Log 11/8-26

Athol Police Log 11/8-26

Arts & Life

Sounds Local: A rock circus returns to Turners Falls: The Slambovian Circus of Dreams brings the fun Friday night at the Shea

The circus is coming to town, and not the kind with elephants and clowns. I’m talking about the Slambovian Circus of Dreams, a rock group from the Hudson Valley in New York that makes music as unique as its name. The band, which has frequently...

Obituaries

Mary M. Thompson

Mary M. Thompson

Mary M. (Powers) Thompson Dade City, FL - Mary M. (Powers) Thompson passed away unexpectedly on Sunday, April 14, 2024. She was born at Langley Air Force Base, in Hampton VA, on February 17, 1968, the daughter of Robert H. and Joan (Lint... remainder of obit for Mary M. Thompson

Nancy C. Skowrowski

Nancy C. Skowrowski

Nancy C Skowronski Royalston, MA - Nancy C Skowronski, born in Worcester, MA on January 1, 1943, lived a captivating life, filled with vibrant memories and impactful experiences that created a lasting legacy. A resident of Royalston, Mas... remainder of obit for Nancy C. Skowrowski

Robert E. Thayer

Robert E. Thayer

Robert E. "Bob" Thayer Athol, MA - ATHOL - Robert E. "Bob" Thayer, 90 of Athol passed away Sunday, April 14, 2023, in the Athol Hospital. He was born on July 13, 1933, the son of Robert H. Thayer and Louise E. (King) Thayer. Bob graduat... remainder of obit for Robert E. Thayer

Chris N. Boyle

Chris N. Boyle

8/5/1956 - 4/11/2024 ORANGE, MA - Chris Boyle, beloved father and husband, passed away on April 11, 2024 at home. Chris led a life of unwavering dedication to his family, a steadfast commitment to the land he cherished, and a love for ... remainder of obit for Chris N. Boyle

Spilka pledges ‘comprehensive climate bill’ in Senate

Spilka pledges ‘comprehensive climate bill’ in Senate

Senate adds bills to reform electric industry

Senate adds bills to reform electric industry

North Quabbin Notes, April 23

North Quabbin Notes, April 23

Mass. saw nearly 200 percent rise in antisemitic incidents last year

Mass. saw nearly 200 percent rise in antisemitic incidents last year

Shelter money fading, but ‘not at the end of the line’

Shelter money fading, but ‘not at the end of the line’

With eye toward teaching firearm safety, Mahar’s Junior ROTC adding air rifles

With eye toward teaching firearm safety, Mahar’s Junior ROTC adding air rifles

Rescuing food and feeding people: Rachel’s Table programs continue to expand throughout western Mass

Rescuing food and feeding people: Rachel’s Table programs continue to expand throughout western Mass A day to commune with nature: Western Mass Herbal Symposium will be held May 11 in Montague

A day to commune with nature: Western Mass Herbal Symposium will be held May 11 in Montague Speaking of Nature: ‘Those sound like chickens’: Wood frogs and spring peepers are back — and loud as ever

Speaking of Nature: ‘Those sound like chickens’: Wood frogs and spring peepers are back — and loud as ever Hitting the ceramic circuit: Asparagus Valley Pottery Trail turns 20 years old, April 27-28

Hitting the ceramic circuit: Asparagus Valley Pottery Trail turns 20 years old, April 27-28